What Is a High-Risk Payment Gateway?

Full Guide for Merchants

If you’re running a business in Forex, crypto, gaming, or even high-ticket e-commerce, you’ve probably hit this wall your payment gateway rejects you — or worse, shuts you down after you’ve already started processing payments.

This isn’t because your business is doing anything wrong. It’s because you’re in what the financial world calls a high-risk industry. And for most traditional payment gateways, high-risk equals high trouble.

When you're labeled high-risk, providers like Stripe, PayPal, Authorize.net, Amazon Pay or Square are more likely to decline your application, freeze your funds, or suspend your account without warning. This creates a frustrating experience for business owners who are simply trying to serve their customers and grow their revenue.

What does “high-risk” actually mean?

A high-risk business operates in industries known for a higher chance of chargebacks, fraud, or regulatory complexity. That could be due to large transaction sizes, subscription billing, global customers, or the nature of your product or service. These risk factors make traditional processors nervous and often unwilling to work with you.

At ZoviPay, we understand the unique challenges high-risk businesses face, that’s why our gateway is built to offer secure, compliant, and scalable payment solutions customised to your needs.

What Is a High-Risk Payment Gateway?

A high-risk payment gateway is a specialized online payment solution built to serve businesses that operate in industries considered risky by banks and traditional payment processors.

These gateways are designed to handle higher levels of chargebacks, fraud risk, regulatory oversight, and transaction volume fluctuations, challenges that standard gateways like Stripe, PayPal, or Square aren’t equipped to manage.

How Is It Different from a Standard Gateway?

While both standard and high-risk payment gateways help businesses accept online payments, there are major differences in how they operate.

| Feature | Standard Gateway | High-Risk Gateway |

|---|---|---|

| Industry Support | Low-risk only | Supports high-risk sectors |

| Approval Process | Simple, Strict | Detailed, Risk-aware |

| Chargeback Handling | Limited | Advanced tools & coverage |

| Risk Tolerance | Low | High |

| Fraud Protection | Basic | Enhanced & customizable |

| Settlement Options | Local, Delayed | Global, Fast, Crypto-friendly |

High-risk gateways are more flexible and are often equipped with advanced tools like smart routing, multi-region MID management, and custom risk rules to help ensure stable payment flows.

Why Are Some Businesses Labeled “High-Risk”?

Payment processors label businesses as high-risk for a variety of reasons, including:

- 1. High chargeback rates (e.g., subscription models, large transactions)

- 2. Global or cross-border transactions (adds fraud exposure)

- 3. Regulated industries (e.g., crypto, gaming, adult, Forex)

- 4. Unstable legal environments or inconsistent compliance

- 5. New or unknown business models

Even if your business is fully legal and compliant, these factors can make traditional processors nervous, which is why having a gateway built for high-risk processing is essential.

What Types of Businesses Are Considered High-Risk?

Not every business can use a standard payment processor — especially if you operate in an industry labeled “high-risk” by acquiring banks and payment gateways.

Here are some of the most common high-risk industries:

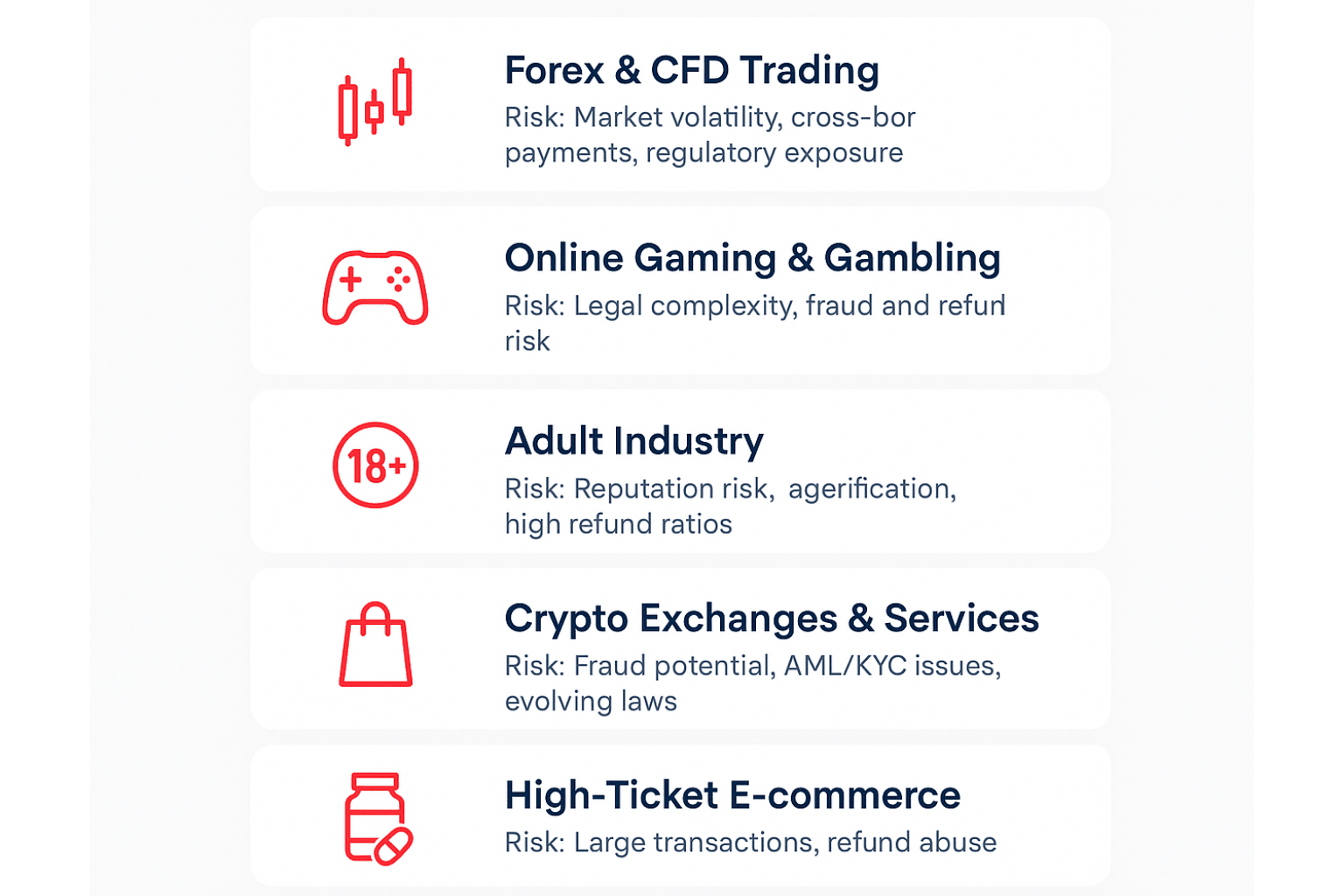

1. Forex & CFD Trading

- 1. Highly volatile markets

- 2. Subject to strict financial regulations

- 3. Frequent cross-border transactions

- 4. High risk of chargebacks due to rapid market movements

2. Online Gaming & Gambling

- 1. Legal status varies by country or state

- 2. Often linked to underage use or fraud

- 3. Higher risk of user disputes and refunds

3. Adult Industry

- 1. Includes content platforms, toys, services, etc.

- 2. Faces reputational concerns and banking restrictions

- 3. High chargeback ratios and age verification challenges

4. Crypto Exchanges & Services

- 1. Operates in a still-evolving regulatory landscape

- 2. Anonymity and wallet-based payments raise fraud risks

- 3. Not supported by most mainstream payment providers

5. High-Ticket E-commerce

- 1. Involves large-value transactions (luxury goods, electronics, etc.)

- 2. Increases risk of chargebacks and refund abuse

- 3. Requires higher fraud protection thresholds

6. Supplements and Nutraceuticals

- 1. Subject to health claims and advertising restrictions

- 2. Regulatory pressure (especially FDA/EMA)

- 3. Common in recurring billing or subscription models

Why Are These Industries Labeled “High-Risk”?

In most cases, it's not about the legality of your business. It's about how financial institutions calculate risk.

Factors that raise red flags for traditional gateways include:

- High chargeback rates

- Regulatory uncertainty

- Cross-border transactions

- Fraud exposure

- Subscription billing models

- Inconsistent consumer protection laws

Because of these variables, businesses in these sectors often need a specialized high-risk payment gateway to process payments reliably and stay compliant.

How High-Risk Payment Gateways Work?

While the goal of any payment gateway is to help businesses accept online payments, high-risk payment gateways operate very differently behind the scenes. They’re built to handle risk at scale, with systems designed to protect both the merchant and the processor.

Here’s a step-by-step breakdown of how high-risk payment gateways work:

1. Transaction Begins at Checkout

When a customer makes a purchase, the payment data (card or digital wallet) is encrypted and sent to the high-risk gateway through a secure API or hosted checkout.

2. Smart Routing & Risk Filtering

Unlike traditional gateways that rely on a single payment processor, high-risk gateways use smart routing to increase approval rates.

The gateway routes the transaction through the most optimal acquiring bank or MID (Merchant Identification Number) based on:

- 1. Transaction type

- 2. Currency

- 3. Region

- 4. Risk score

- 5. Time of day

This maximizes the chances of approval and reduces declines caused by risk flags or mismatched regions.

3. Fraud Detection in Real Time

Before approval, transactions are passed through advanced fraud detection engines using:

- 1. Velocity checks

- 2. Device fingerprinting

- 3. Geolocation tracking

- 4. BIN validation

- 5. Blacklists & AI scoring

These systems are often customizable — customised to the merchant’s risk profile and industry type.

4. Authorization by the Acquiring Bank

Once cleared, the transaction is forwarded to the most appropriate acquiring bank. The bank either approves or rejects it based on its risk rules and compliance requirements.

ZoviPay, works with multiple global acquiring partners to ensure better routing flexibility and stability, especially useful for Forex, crypto, or cross-border merchants.

5. Funds Settlement & Reporting

If the transaction is approved, funds are collected and later settled to the merchant based on their payout schedule, which could be daily, weekly, or even instantly (in some crypto or stablecoin models).

High-risk gateways typically offer:

- 1. Multi-currency settlements

- 2. USDT or crypto-based payouts

- 3. Real-time dashboards for analytics, reconciliation, and chargeback tracking

.png)

How They Manage Risk Differently Than Standard Gateways

| Standard Payment Gateway | High-Risk Payment Gateway |

|---|---|

| 1 MID for all | Multiple MIDs by region & industry |

| Limited fraud tools | Advanced, customizable risk engine |

| High decline rates | Smart routing for higher approval |

| Simple rules | Adaptive risk scoring and learning |

| One acquiring bank | Network of global acquiring partners |

By distributing risk across multiple MIDs and banks, high-risk gateways reduce the chance of account freezes, improve stability, and give merchants greater control.

Key Features of a High-Risk Payment Gateway

Not all payment gateways are built the same, and for high-risk businesses, choosing the right one can make the difference between growth and shutdown. Here are the core features that define a high-risk payment gateway and why they matter for your business.

1. Smart Transaction Routing

Instead of relying on a single processor, high-risk gateways use smart routing to direct each transaction through the best possible acquiring bank or MID (Merchant Identification Number). This boosts approval rates and ensures more of your transactions go through successfully — even during peak hours or from high-risk countries.

2. Multi-Region MID Management

Most standard gateways assign a single MID to your account. High-risk gateways, like ZoviPay, offer access to multiple MIDs across different regions, which spreads the risk and reduces the chance of account freezes or volume limits.

3. Advanced Fraud Detection

High-risk industries attract more fraud attempts, which is why these gateways come with real-time fraud screening tools like:

- Device fingerprinting

- Velocity checks

- Geolocation

- AI-based risk scoring

- Custom blacklists and rules

These help you reduce chargebacks and stay compliant with card network rules.

4. Multi-Currency & Crypto Settlement

Whether you’re dealing in USD, EUR, GBP — or want to settle in USDT or other stablecoins, a high-risk gateway offers flexible settlement options to match your business model and global customer base.

5. Fast & Flexible Payouts

Standard providers may delay payouts or hold funds. High-risk gateways are built for speed, offering:

- Daily, weekly, or custom payout cycles

- Bank wires, e-wallets, or crypto withdrawals

- Real-time reporting dashboards

6. PCI-DSS Compliance & Security

Security is critical. High-risk gateways follow PCI-DSS standards and offer secure checkout options (API or hosted), ensuring your business stays compliant and protects sensitive customer data.

7. Chargeback Management Tools

Chargebacks are common in high-risk sectors. The best gateways offer:

- Alerts before disputes occur

- Chargeback representment services

- Analytics to track dispute trends

- Tools to reduce future risk

.png)

Why You Can’t Use Standard Payment Gateways

If you run a high-risk business, platforms like Stripe, PayPal, and Square might seem like easy choices. But what most merchants learn—too late—is that these platforms aren’t built to handle the complexities of high-risk industries.

Here’s why standard payment gateways usually don’t work for high-risk merchants:

Account Freezes Without Warning

Traditional gateways operate with automated risk detection systems. If your business is flagged, whether due to industry type, chargeback rate, or transaction volume, your account may be suspended or permanently frozen without notice. That means no payments in or out, and funds held for months.

Payout Delays or Withheld Funds

Even if your account isn’t shut down, many traditional processors delay payouts or hold a percentage of your balance in reserve if they detect increased “risk.” For high-risk merchants, this disrupts cash flow and makes scaling nearly impossible.

No Support for High-Risk Verticals

Most standard gateways don’t officially support industries like:

- 1. Online trading (Forex, CFDs)

- 2. Gambling & gaming

- 3. Adult content

- 4. Crypto exchanges

- 5. Supplements & nutraceuticals

If your business model falls into one of these categories, you're already on borrowed time with these providers.

Limited or No Custom Risk Controls

High-risk businesses require advanced fraud protection, chargeback management, and dynamic transaction routing. Most traditional gateways offer basic fraud filters at best, with no ability to customize controls, add rules, or manage multiple merchant accounts (MIDs).

Why It Matters

Using the wrong gateway doesn’t just cause friction, it can shut your business down entirely. High-risk businesses need infrastructure that’s built for their level of complexity, regulation, and exposure.

That’s where high-risk payment gateways step in, offering the flexibility, tools, and protections you simply won’t find with standard processors.

Benefits of Using a High-Risk Payment Gateway

Choosing the right payment gateway can mean the difference between constant stress and smooth global operations. For high-risk businesses, a specialized gateway isn’t just helpful — it’s critical.

Here’s what you gain when you switch to a high-risk payment gateway like ZoviPay:

Higher Approval Rates

High-risk gateways are built to support industries that traditional processors reject. With smart underwriting and industry-specific criteria, these gateways give you a much better chance of getting approved and staying approved.

Global Coverage & Multi-Currency Support

Want to accept payments from Asia, LATAM, CIS, or Europe? Our High-risk payment services is global by design, offering:

- 1. Multi-currency acceptance

- 2. Cross-border processing

- 3. Localized routing for better conversion rates

This opens your business to international growth — without payment limitations.

Smart Transaction Routing

Instead of relying on one acquirer, high-risk gateways use smart routing technology to direct transactions through the most suitable bank or processor. This:

- 1. Increases success rates

- 2. Minimizes declines

- 3. Reduces fees and downtime

Chargeback Management & Fraud Protection

Chargebacks and fraud are part of high-risk business, but they don’t have to sink you. These gateways often include:

- 1. Chargeback alerts and prevention tools

- 2. AI-powered fraud scoring

- 3. Customizable risk filters and rules

This proactive risk management saves both revenue and reputation.

Faster & More Reliable Payouts

Unlike standard gateways that freeze or delay payments, high-risk providers are used to fast-moving industries. Expect:

- 1. Daily or weekly payouts

- 2. Support for crypto settlements like USDT

- 3. Stable cash flow, even during high volume spikes

Customization & Expert Support

High-risk gateways don’t use a one-size-fits-all approach. They provide:

- Custom merchant accounts based on region, industry, and volume

- Dedicated support teams who understand your niche

- Advanced reporting for better decisions

Built for Scaling

With tools like multi-region MIDs, hosted checkouts, and real-time dashboards, high-risk gateways help you scale, safely and efficiently.

With ZoviPay, you don’t just get a way to accept payments, you get a platform purpose-built for high-risk industries, combining global scalability, compliance-ready infrastructure, and the tools you need to grow with confidence.

Features to Look For in a High-Risk Payment Gateway

Not all high-risk gateways are created equal. To truly support your business, your gateway needs more than just approval—it should provide the infrastructure, tools, and flexibility that high-risk merchants depend on.

Here are the essential features to look for when choosing the right provider:

✔️ Multi-Region MID Management

Look for gateways that offer access to multiple acquiring banks and merchant IDs (MIDs) across different regions. This helps distribute risk, improve uptime, and scale smoothly across geographies.

✔️ Smart Routing Engine

Your gateway should use intelligent transaction routing to send each payment through the best-performing bank or processor. This boosts:

- 1. Authorization rates

- 2. Conversion

- 3. Customer satisfaction

✔️ Real-Time Merchant Dashboard

Access to a live dashboard lets you monitor transactions, detect anomalies, and manage settlements, all in real time. For high-risk businesses, transparency is key.

✔️ Chargeback & Fraud Protection

Choose a provider that offers:

- 1. Chargeback alerts & prevention

- 2. AI-based fraud detection

- 3. Customizable security rules

These tools help reduce losses and maintain a healthy MID.

✔️ Flexible Settlement Options

A good high-risk gateway should support multiple currencies and crypto-based settlements (like USDT), giving you fast, borderless access to your revenue.

✔️ PCI-DSS Compliance & Data Security

Security is non-negotiable. Ensure the gateway is PCI-DSS certified, with data encryption and tokenization protocols to protect your business and your customers.

✔️ 24/7 Human Support

When you're operating globally, issues can happen at any time. Your provider should offer around-the-clock support — ideally with agents who understand high-risk operations.

✔️ Scalable & Future-Proof

Whether you're processing $50K or $5M per month, your payment partner should scale with you. That means offering APIs, hosted checkout, integrations, and localization tools to match your growth.

👉 Pro Tip: We includes all of the above, and more. Making it a reliable partner for high-risk merchants looking to grow securely across global markets.

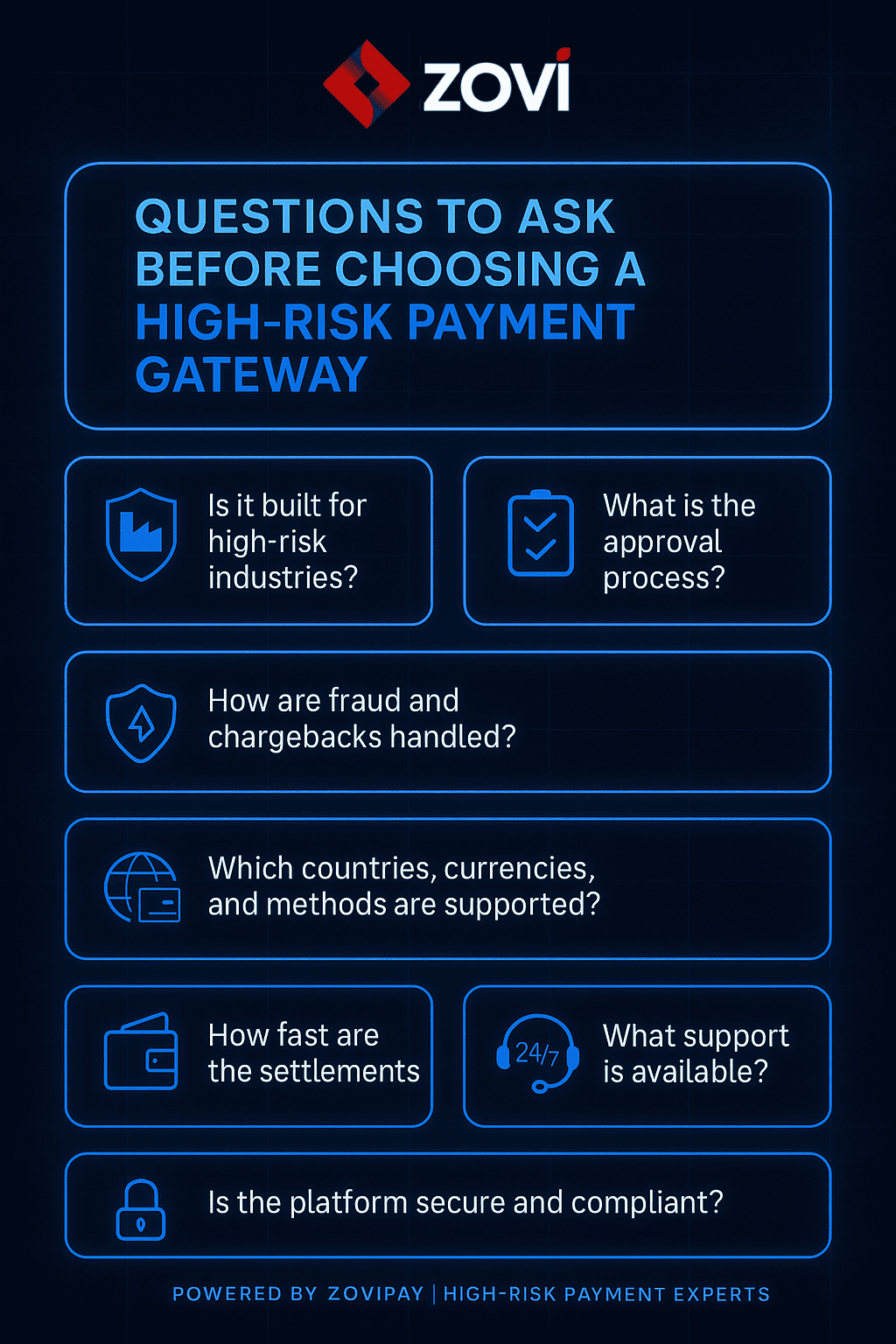

Questions to Ask Before Choosing a High-Risk Payment Gateway

Choosing a high-risk payment gateway isn’t just about getting approved, it’s about finding a partner that will protect, scale, and support your business long-term.

Before you Sign Up for a Merchant account, here are the most important questions to ask your provider:

Q1. Is Your Gateway Specifically Built for High-Risk Industries?

Some providers claim to support high-risk businesses but don’t have the tools or experience to back it up. Ask if they serve verticals like Forex, Crypto, Gaming, or high-risk ecommerce, and how they manage risk for those industries.

Q2. What Is Your Approval Process Like?

A true high-risk gateway should offer:

- Fast underwriting (1–3 days)

- Transparent document requirements

- Industry-specific onboarding

This shows they understand the unique needs of your business.

Q3. How Do You Handle Chargebacks and Fraud?

High-risk businesses face more fraud and disputes — so you need to know:

- Do they offer chargeback alerts or prevention tools?

- Is there fraud scoring or velocity control?

- Can you set custom rules for risky countries or user behavior?

Q4. What Are the Supported Regions, Currencies, and Payment Methods?

A good provider should support:

- Cross-border payments

- Multiple currencies

- Alt methods like e-wallets, crypto, and mobile payments

This is essential if you’re targeting users outside North America or Europe.

Q5. Are Settlements Fast and Flexible?

Cash flow is critical. Ask:

- How often are payouts? (daily, weekly?)

- Can they settle in USDT or other stablecoins?

- Is there a delay or reserve held on funds?

Q6. What Kind of Support Will I Get?

You don’t want to be stuck with a bot when your checkout stops working. Ask:

- Is support available 24/7?

- Do they offer a dedicated account manager?

- Are response times fast?

Q7. How Do You Keep My Business Compliant and Secure?

Make sure the provider is:

- PCI-DSS certified

- Following global KYC/AML practices

- Using encryption, tokenization, and data protection standards

Asking these questions helps you avoid costly mistakes and choose a gateway that’s truly invested in your industry’s success.

ZoviPay offers detailed onboarding, chargeback prevention, real-time routing, and full global support — making it easy for high-risk merchants to start strong and scale fast.

Conclusion

Choosing the right payment gateway is critical for merchants operating in high-risk industries. The right provider not only ensures smooth, secure, and compliant transactions but also supports your business growth by minimizing disruptions and chargebacks. With the complexity and unique challenges of high-risk payments, evaluating your payment gateway options carefully is essential to finding a solution that truly understands your needs.

By partnering with a payment gateway designed specifically for high-risk merchants, you gain more than just a way to process payments, you gain a trusted platform that prioritizes compliance, reliability, and scalability.

Ready to simplify and secure your high-risk payments?

Get in touch with us today and grow your business with ease and confidence.